Free Consultation: 01423 520873

Inheritance Tax

Inheritance Tax is the tax that is paid on your 'estate'. Broadly speaking this is everything you own at the time of your death, less what you owe. It's also sometimes payable on assets you may have given away during your lifetime. Assets include things like property, possessions, money and investments. The rapid growth in property values over recent years means more people are falling into the Inheritance Tax trap. You should seek Inheritance Tax advice is you are:

Single or divorced with an estate of approximately £325,000

Married or in civil partnership with an estate of approximately £650,000

Widowed with an estate of approximately £650,000 or where some of the Inheritance Tax allowance was used on the death of your spouse

Inheritance Tax is charged at 40% of your estate, which is in excess of your 'tax free allowance' (nil rate band). Which if you are single is any amount over £325,000 or if you're married / civil partner or widowed is any amount over £650,000. Should you pass on your family home to a descendant you get an extra allowance of £175,000 each providing a tax free allowance of one million pounds.

If you leave everything to your spouse or civil partner there'll be no Inheritance Tax to pay because they are classed as an exempt beneficiary but on their death Inheritance Tax is charged on any amount over £650,000 or one million pounds if you pass on your family home to your descendants.

With good advice there could be ways of reducing your Inheritance Tax liability. Your starting point should always be to write a Will and keep it up to date, but this is no substitute for proper lifetime tax planning.There are ways to mitigate Inheritance Tax liability which includes:

Ensure your Will is written and planned correctly to save the maximum amount of tax.

Make use of all current exemptions and reliefs.

Transfer assets through the prudent use of lifetime gifts.

Create a tax-efficient fund to enable the beneficiaries of an estate to meet the tax liability without disturbing the family wealth.

Exemptions from Inheritance Tax

There are certain exemptions from Inheritance Tax which include, but are not limited to:

Married or in Civil Partnership

If your estate passes to your husband, wife or civil partner and you're both domiciled in the UK there is no Inheritance Tax to pay even if it's above the £325,000 nil rate band

Annual exemption

Gifts of up to £3,000 per donor each tax year are exempt, and any unused balance can be carried forward for one year only.

Small gifts

Outright gifts not exceeding £250 per recipient are exempt.

Marriage gifts

Gifts in consideration of a marriage are also exempt - up to £5,000 from a parent, £2,500 from a grandparent or £1,000 from anyone else.

Normal expenditure from income

Regular gifts from normal income which do not reduce your standard of living are exempt from Inheritance Tax. There is no maximum limit on the value of this exemption but such gifts cannot be drawn from your capital, such as savings or investments. Nor could they be funded by the sale of an asset.

Gifts to charity including churches, schools and hospitals

Most gifts made more than seven years before your death

FREE Consultation.

Make an Appointment

By providing my phone number, I agree to receive emails and SMS text messages from the Andrew Wright Practice.

Address and email

Email: [email protected]

Address

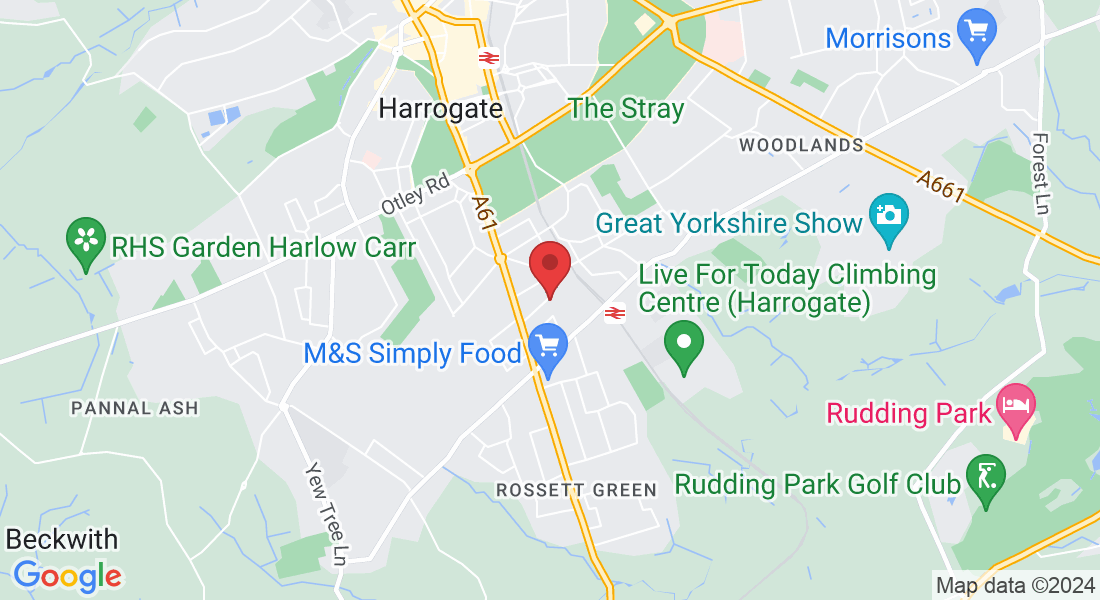

Andrew Wright Practice,

43 Tewit Well Road,

Harrogate,

North Yorkshire, HG2 8JJ

Get In Touch

Office Hours

Mon – Fri 9:00am – 5:30pm

Saturday - CLOSED

Sunday – CLOSED

Phone Number: